Bitcoin boosts portfolio returns without increasing risk

by Matt Hougan via X

Bitcoin and gold have historically had very different impacts on portfolios. Over the long-term, one has boosted returns without increasing risk, while the other has lowered risk without lowering returns. A thread inspired by my latest CIO Memo.

Note: Not investment advice. This is a historical study. Past performance is no guarantee of future returns. Please see the disclaimers below the tables.

The best way to understand how bitcoin and gold impact portfolios is to look at what happens historically as you add more and more of each asset to the mix.

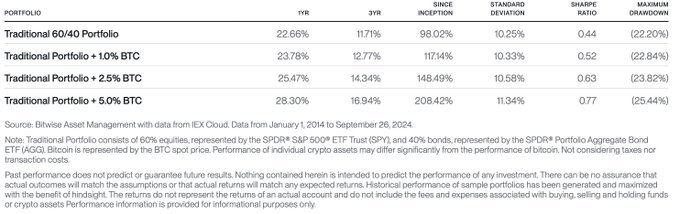

The table below shows the impact of adding 1.0%, 2.5%, and 5.0% bitcoin to a traditional 60/40 portfolio of stock and bonds . The study covers January 2014 to the present.

Historically, as you add more and more bitcoin, the portfolio’s total return rises dramatically. Meanwhile, the Standard Deviation column -- a measure of volatility -- barely moves.

According to the simulation, a 2.5% allocation to bitcoin would have boosted the portfolio’s return 50 percentage points, from 98% to 148%, while the standard deviation would have risen just 33 bps. Amazing!

Contrast that with what happens when you replace bitcoin with a gold ETF. As the table below shows, there is almost no effect on return: Over the full 10+ years of the study, a 2.5% allocation to GLD would have boosted the portfolio returns by just 1%!

Where gold does have an impact, however, is on the volatility side (check the Standard Deviation column again), which falls as you add more and more GLD to the mix.

Each asset tells a story of trade-offs. More returns for essentially the same risk? Look to bitcoin. Basically the same returns for less risk? Look to gold. Both are great outcomes, but they are critically different.

There's no guarantee that these same features will persist in the future. But as we enter a new era of global government stimulus, it's important to remember that these two assets are different, and do different things for portfolios.